Despite public finances improving last year, 2021 still ranked as the third highest year ever for government borrowing.

Interest payments on the national debt rose to their highest level ever last year, as the UK’s public finances reel from the huge cost of the pandemic.

The government’s statistics department said the debt pile stood at £2.3tn last month, with interest payments rising to nearly £70bn, a record amount according to the Office of National Statistics (ONS).

Government borrowing last year was down by half on 2020, when the state paid many workers to stay at home in an attempt to control the spread of COVID-19.

Yet 2021 still ranked as the third highest on record for public borrowing. The state deficit hit £151.8bn in the 12 months to March 2022, compared to £317.6bn in the previous year.

Despite the reduced level of borrowing, the government still borrowed £24bn more than expected last year.

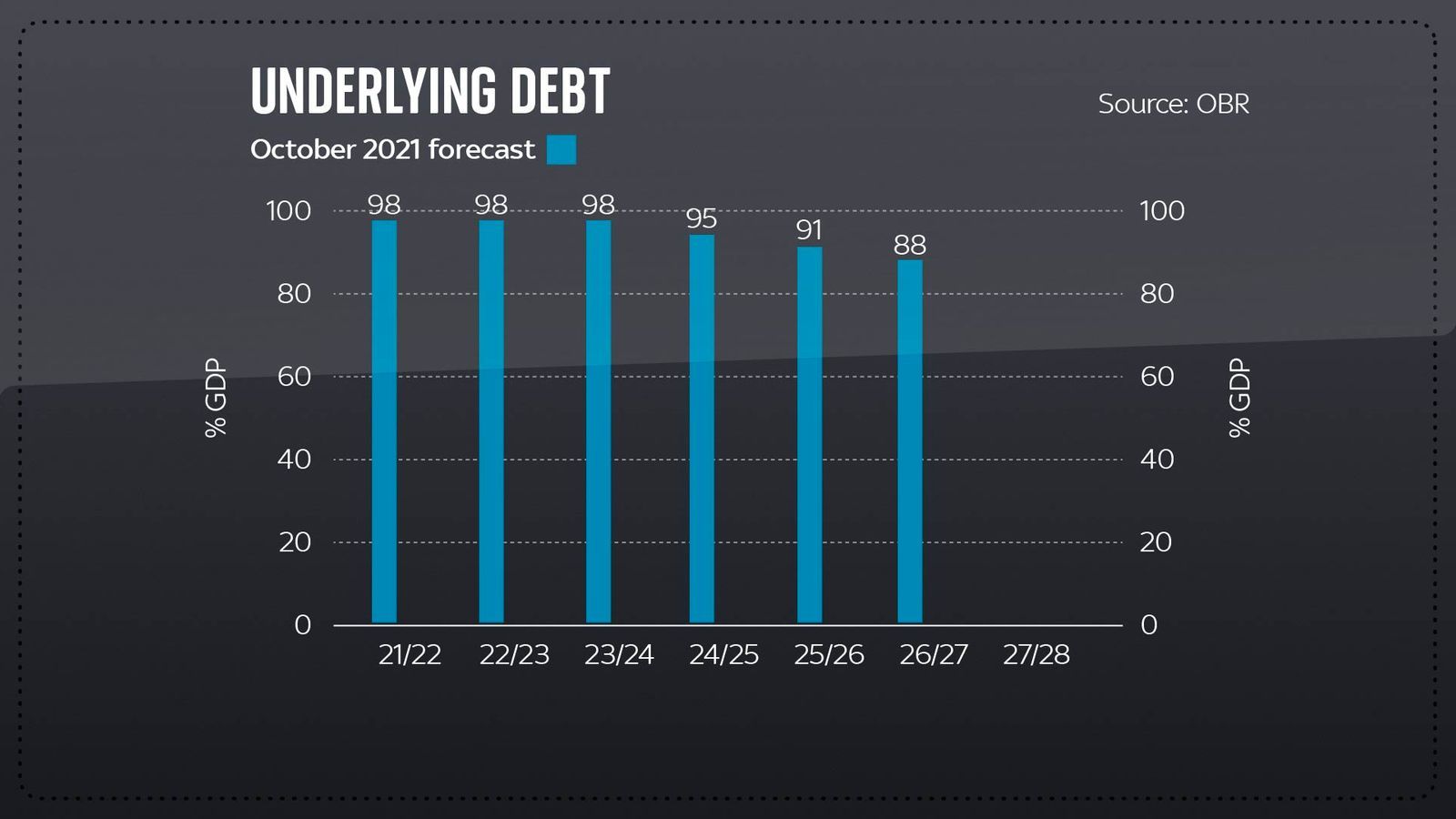

Chancellor Rishi Sunak said that while the state’s finances were improving with the reopening of society, heavy borrowing throughout the pandemic had left the government saddled with debt.

“Public debt is at the highest levels since the 1960s and rising inflation is pushing up our debt interest costs, which mean we must manage public finances sustainably to avoid saddling future generations with further debt,” said Mr Sunak.

The phasing out of COVID-19 restrictions has boosted the government’s coffers in the past year, according to the ONS.

Tax income to the government was £619.9bn in the past year, an increase of £94.3bn on 2020.

The national debt pile stood at £2.3tn last month

The national debt pile stood at £2.3tn last month

“This is a real glass half full moment for the UK economy,” said Danni Hewson, AJ Bell financial analyst. “The phasing out of covid restrictions and the end of support measures like the furlough scheme have helped the country surge back to its feet.”

Mr Hewson pointed out, however, that inflation was likely playing a significant role in the higher tax receipts.

“VAT receipts are up by £25bn and those soaring prices at the pump along with the restart of the ‘big commute’ has netted an extra £5bn in fuel duty,” he said. But “that doesn’t minimise the £22.5bn in extra PAYE or £6.8bn from self-assessment payments.”

The country is now facing a cost of living crisis that is only likely to worsen Britain’s public finances.

Many people in Britain are facing an increase in energy bills, council tax and the effects of a National Insurance tax rise - as well as inflation hitting a 30-year-high of 7% earlier this month.

On Tuesday, a minister warned that there was "no golden bullet" to solve the crisis, as Boris Johnson prepares to ask his Cabinet ministers to help him find solutions to ease the pressure on household finances.

Armed Forces minister James Heappey told Sky News there is "no doubt" that any interventions by the government will be "expensive", but added that "cumulatively" a range of measures could "start to make a difference".

"There's no doubt about these interventions are expensive - £22bn of government intervention to assist with families with their cost of living is already huge," he said.