Why do so many of us think we can successfully haggle over the price of a new car with a professional salesman?

After all, it's not like they do it for a living, or are trained, or have decades of experience, is it?

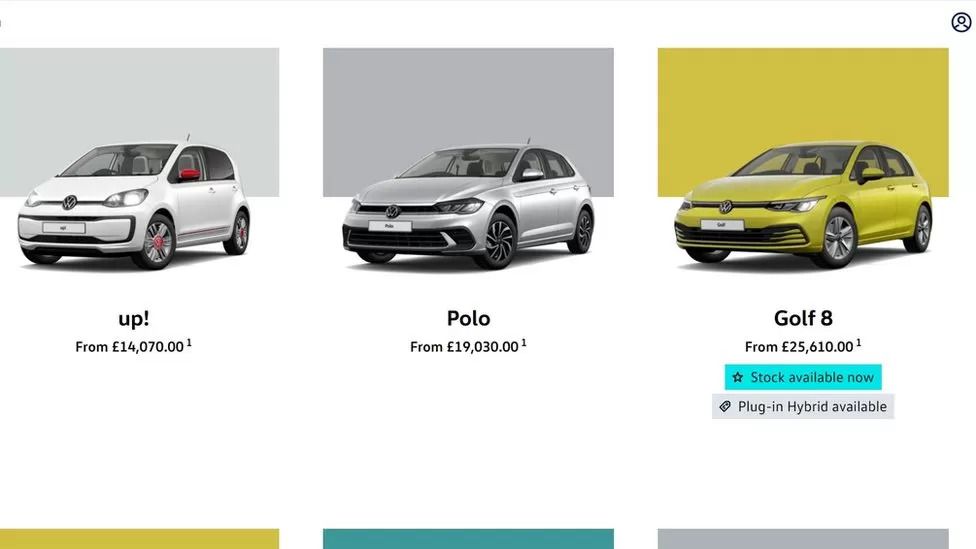

But things are changing on the forecourt. UK car dealerships, currently still mostly independently owned franchises, are facing a number of threats.

The coronavirus pandemic was the driving force behind an already existing trend that is now rapidly changing the car industry.

Instead of visiting one of the 4,500 car showrooms across the UK, or even several, test driving the vehicle, then picking a car and haggling with the sales team, customers are increasingly trying something new.

These days people are far more likely to search online for the car they want, picking two or three to look at. They then only visit the showroom to make their final choice and, perhaps, try to get some discount on the price advertised online.

The car industry has embraced the internet, but most of us still currently also visit a physical showroom

The car industry has embraced the internet, but most of us still currently also visit a physical showroom

"You find your vehicle on the website of the big car company, you trust its brand, but you still get it delivered through some local sales point, you can meet someone when you get the car."

However, Sue Robinson, chief executive of the National Franchised Dealers Association, begs to differ. She points out that "people still like to go to the showroom, and on average make 3.1 trips there before buying a new car".

But the number of visits to showrooms before purchasing a car is falling. People shop around online far more and are, therefore, far less influenced by the sales staff.

This new hybrid model of buying, where you first look online and then go to a showroom, is increasingly popular. It was exactly how I bought my new car last year.

My wife and I researched what type of car we wanted, picked out the perfect model, and then searched for the second-hand example that we could afford that was on sale near us, and we did all that online. Only then did we visit a showroom, check out the car, go for a test drive and make a decision to take the vehicle home with us.

Car dealerships in the UK are currently mostly independently owned franchises

Car dealerships in the UK are currently mostly independently owned franchises

We could have gone further, because 10% of UK sales are now said to be completed totally online, with the buyer not seeing the car until it is delivered to his or her doorstep.

These sales are lost to the car showroom owners, and this new buying method is here to stay.

So too is the move towards electric vehicles. Purely electric and plug-in hybrids now make up 20% of all new cars, and that proportion can only increase in the coming years.

Not only has the massive hike in fuel prices encouraged this trend, but new petrol and diesel car sales will be banned in the UK by 2030. That means dealerships will have to spend money retraining their staff to repair and maintain electric and hybrid vehicles.

And since electric vehicles have far fewer moving parts it should mean they need less servicing.

This too may pose a threat to the traditional car dealership, says Professor Stadler. "If servicing is less of an issue then the relationship with the dealership may become less important.

"There could be more of a separation between dealer and servicing. Now we buy a car and get it serviced and repaired at the same place. That might separate in future."

But Robert Forrester is not that convinced by that argument. He is chief executive of Vertu Motors, which has 160 dealerships selling cars for BMW, Audi, Nissan, Ford and several others. It has 4% of the new car market in the UK and employs 6,500 people.

Robert Forrester is confident that dealerships are here to stay

Robert Forrester is confident that dealerships are here to stay

As he points out, the cars of today might need less servicing but they can no longer be serviced at home. "The only people who will be able to repair and fix cars going forward will be the franchise dealer, who has the expertise to do it," he says.

Whoever is right, the move towards servicing electric vehicles will be a game changer for the industry. The need to retrain staff will accelerate and dealers who don't invest in the latest technology will lose out.

The independent dealerships are also coming under pressure from some of the car manufacturers deciding to do away with such franchises, and instead open their own company-owned and runshowrooms.

Tesla, which has the advantage of being a new entrant into the market, has adopted this direct-selling model from the very start.

Tesla has always directly owned its showrooms

Tesla has always directly owned its showrooms

Two other carmakers are now also opening directly owned showrooms - Audi and DS. And others, including VW, Audi and Mercedes, are rumoured to be thinking about following suit.

Franchise owners have in the past made about 7% profit on every car they sold, but the car firms are said to now think that is too generous, and want some of that money back.

"There are some carmakers who are a long way along [the journey to owning their own dealerships], and others are waiting to see whether it works," says Ms Robinson.

Although taking over the dealerships means taking on the costs of property, staff and promotion, the carmakers get to sell their product at a set price of their choosing.They won't have to offer discounts to dealers to shift stock, and it gives them other advantages as well.

"It gives you more data, and if you have your hands directly on the sales you get a better sense of what the customers are doing," says Prof Stadler.

In coming years that data will become increasingly important as the way people own cars is likely to change.

In the future cars may be regarded more as "mobility solutions", something to hire for limited periods, rather than something to buy. This would give you, for example, the chance to swap your city runaround for a bigger car during the holidays, or take out a convertible for the weekend.

There could be car clubs, or paying by the hour or mile. All of that becomes far easier if the car companies have your data and can use it to fashion a deal that works for you, and them of course.

At Vertu Motors Robert Forrester is not worried, however. He says the car manufacturers will still need salesrooms and sales people, but they will be paid a flat rate by the carmaker rather than trying to make a profit on every car sale.

He adds the only difference customers will notice is that "the invoice will come from the manufacturer not the retailer".

But it could well mean less room to haggle, and less competition between showrooms selling the same brand and model. Haggle while you can, it may not be an option for much longer.