The UK has been exporting gas to the continent at maximum capacity and is currently not witnessing the wholesale prices seen over the North Sea and Channel, but that may not last much longer.

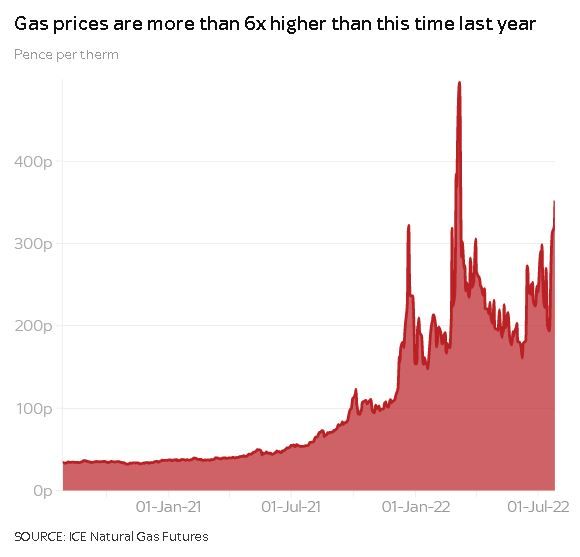

Growing fears Russia may switch off supplies of natural gas to Europe have pushed UK wholesale prices to levels last seen in the early days of the war in Ukraine, with a market expert telling Sky News there is worse to come.

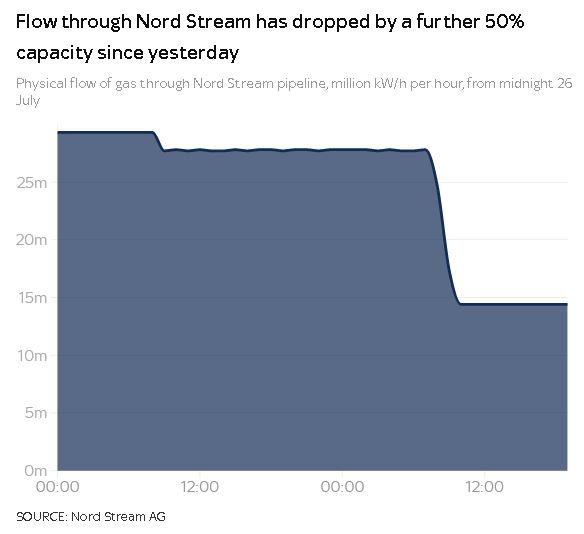

The contract for next-month UK delivery was more than 12% higher at one stage on Wednesday after flows from the Nord Stream 1 pipeline, which provides more than a third of Russian gas to the EU, were cut to 20% of capacity from 40%.

The move, blamed by state-owned Gazprom on maintenance delays, has exacerbated fears that the bloc's reliance on Russian gas is being used as a weapon by the Kremlin in revenge for Western sanctions over the Ukraine invasion.

The Kremlin has cited sanctions-driven technical issues with equipment preventing Gazprom from exporting more.

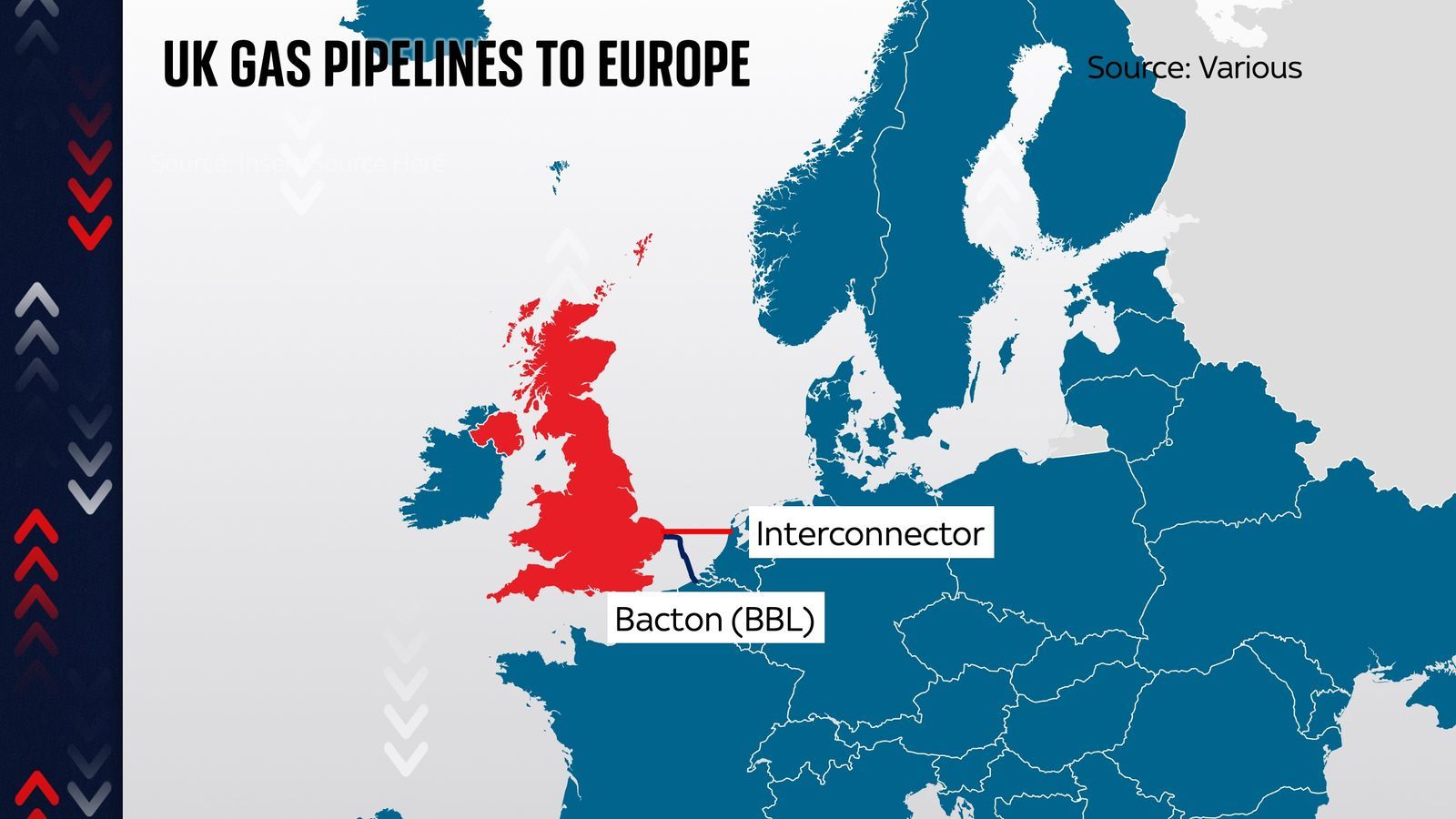

While Russian gas only accounts for 4% of UK supplies traditionally, a lack of storage combined with many other factors including stable North Sea output during the warm months of low demand has allowed the country to help its neighbours on the continent by exporting gas at record volumes.

Nevertheless, UK wholesale prices for August have been rising sharply for more than a week and were hovering just below 400p a therm - last seen in March - in volatile trading early on Wednesday from a figure nearer 360p the previous day.

The main North European price was up by €26.18 to €222.50 per megawatt hour.

When measures of UK and European costs are compared, it shows the UK wholesale price was about 30% lower than its continental counterpart.

The price gap will soon close

Tom Marzec-Manser, head of gas analytics at commodities specialist ICIS, said of the difference: "British gas prices remain at a discount with those on the continent… as Britain is oversupplied with LNG (liquified natural gas) arrivals and cannot export surplus volumes to the European mainland at quick enough rates.

"Britain only has a small amount of gas storage capacity, too, so much of the arriving surplus cannot be stored in reserve for winter."

He said the lack of storage meant there would be a price consequence ahead: "ICIS data show the gas market expect the discount held by British wholesale prices will evaporate as winter begins and demand rises."

There were already signs of rising prices ahead as the UK wholesale price for October delivery rose 30% to 490p on Wednesday despite being far less exposed to the supply crunch.

Data shows European stocks at just 66% of capacity ahead of winter and the EU has responded with a voluntary plan for member states to curb gas use by 15% in a bid to prevent costly outages including factory shutdowns.

Low stocks following a cold end to the winter of 2020/2021 helped start the price spiral before it was elongated by Russia's invasion of Ukraine and the resulting cuts to gas flows.

Data from Nord Stream 1 operators showed that volumes fell early on Tuesday and again on Wednesday.

Economists have warned that recession is inevitable in the event heavy users of Russian gas, including Europe's largest economy Germany, have to take extraordinary measures to ration supplies.

Berlin accused the Russian government of a "power play" through its management of Nord Stream 1.

The gas price situation, ultimately, threatens to exacerbate the cost of living crisis across Europe.

What it means for the UK

The Bank of England predicts that UK inflation will pass 11% in the coming months, but the latest price shifts for gas may force policymakers to ramp up their prediction when they next meet in a week's time.

That is because the cost of natural gas has been the driving force behind increases to energy bills - for households and businesses alike.

The inflation problem is made worse for consumers when firms pass on their own higher energy and fuel bills down the supply chain, making goods and services more expensive across the board.

The energy price cap is predicted by industry experts to hit an average £3,244 per year from October and then pass £3,300 in January at the next review.

The cap currently stands at an average £1,791.

MPs' this week demanded the government raise its £37bn cost of living support package for households in anticipation of the price surge to come.

The big question is whether the shock to bills will be even worse than anticipated.

The answer, for this winter, probably lies with Vladimir Putin at the Kremlin.