It's a no-go for a pure Bitcoin exchange-traded fund.

The Securities and Exchange Commission on Friday rejected VanEck's application submitted earlier this year, noting the firm did not demonstrate it could adequately protect investors under exchange rules that are "designed to prevent fraudulent and manipulative acts and practices" and "to protect investors and the public interest."

VanEck CEO Jan van Eck, in a statement to FOX Business, said:

"We are obviously disappointed in today’s update from the SEC declining approval of our physical bitcoin ETF. We continue to believe that investors should have the ability to gain exposure to bitcoin through a regulated investment product and that a non-futures ETF structure is the superior approach."

The firm did not elaborate on next steps.

Bitcoin, which hit an all-time high this week of $66,990.90, traded lower on Friday and has advanced over 116% this year. Investors are using the asset as a hedge to inflation. This week consumer prices jumped 6.2% in October, the fastest in 31 years.

While the market is void of a physical bitcoin, ETF-related products have passed muster with regulators.

ProShares Bitcoin Strategy ETF, which began trading last month, made a splash listing on the NYSE.

"Putting together a belt and suspenders approach of the regulated futures market and a regulator ETF really provides a robust solution for investors and one they can just put in their brokerage account, trades like a stock," ProShares Global Investment Strategist Simeon Hyman said during an interview on FOX Business’ "The Claman Countdown."

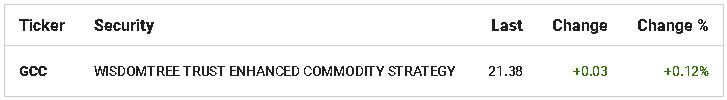

Additionally, WisdomTree’s Enhanced Commodity Strategy Fund beefed up the ETF by adding a 3% allocation to cash-settled Bitcoin futures traded on the Chicago Mercantile Exchange, giving investors a little crypto mixed in with commodities.

"It invests in a broad array of different commodities from gold to livestock to oil and is really focused on a broad commodity exposure. We thought that adding Bitcoin futures would add further differentiation," Ryan Louvar, general counsel at WisdomTree, told FOX Business last month.