Jeffrey Sprecher, CEO of Intercontinental Exchange, oversees a $63B company

Jeffrey Sprecher, husband of Sen. Kelly Loeffler, R-Ga., is now a billionaire, according to Bloomberg, as his Intercontinental Exchange (ICE) saw its stock rise more than 22% in 2020.

Sprecher is the CEO of ICE, which owns the New York Stock Exchange, and he owns approximately 1% of the company.

The company's market value is more than $63 billion (market capitalization or market value is a common method of measuring the size of a publicly-traded company and it is calculated by multiplying the current stock price by the number of shares outstanding).

As a result of its rising value, ICE continues to grow. Earlier this year it purchased Ellie May, which processes more than 40% of all new U.S. residential mortgages. With the explosion in housing sales during the pandemic and borrowing costs at record lows, Ellie May has been a booming business for ICE.

"I really don’t know how to manage a company that isn’t growing,” Sprecher said on an ICE podcast in May. “Part of managing a growing company is like the duck with your legs moving very quickly underneath. I wouldn’t really know how to float around.”

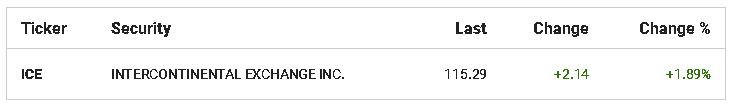

ICE's stock closed Wednesday at more than $113 per share. At its low point in 2020, it was approximately half that. ICE declined to comment on Sprecher's reported billionaire status.

Loeffler is in the middle of a hotly contested Senate race against Raphael Warnock with elections coming Jan. 5. The outcome of the race could determine which party controls the Senate. She first took office after Sen. Johnny Isakson retired in 2019 and Gov. Brian Kemp appointed her to take his place.

During her campaign, Loeffler has faced criticism from Democrats for her and her family's wealth. She faced investigations by the Justice Department and the Senate Ethics Committee after she and Sprecher sold stock shares following a briefing on the coronavirus before the pandemic led to a market crash. Those sales included transactions in shares later affected by the global pandemic.

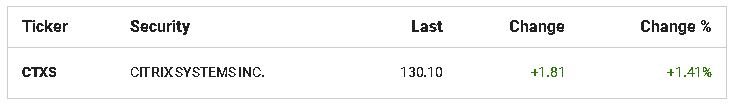

The briefing took place on Jan. 24, and Loeffler sold stock that same day. Between Jan. 24 and Feb. 14, she and Sprecher made more than 20 stock sales between $1.275 million and $3.1 million. In addition, the couple's portfolio saw stock purchases in two companies, one of which was Citrix, which produces teleworking software.

During the pandemic, several companies involved in teleworking and teleconferencing have witnessed rising stock prices. Citrix stock is up more than 16% year to date

Loeffler claimed that her stock trades were made by a third-party financial adviser. Both the Senate and Justice Department eventually dropped their investigations without finding wrongdoing.