Bitcoin Foundation chair reacts to lawsuit targeting crypto exchange Gemini

Bitcoin Foundation Chairman Brock Pierce argued on Thursday that there is a need for clarity as to which agency should regulate the cryptocurrency industry.

Pierce noted on "Mornings with Maria" that "one of the biggest concerns in this space is security vulnerability" and noted that "we are upgrading the insecure infrastructure that comprises the Internet today."

"Crypto is at the forefront of experiencing all of those pains, but as a result of that we’re going to live in a more secure future," Pierce said.

The crypto billionaire provided the insight reacting to a lawsuit against cryptocurrency exchange Gemini, following the February theft of $36 million of crypto assets in Gemini's custody belonging to retirement accounts, a news release stated.

IRA Financial, a company that provides services for self-directed retirement and pension funds, is suing Gemini, which is owned by the Winklevoss twins Cameron and Tyler, over the company’s alleged failure to prevent the hack.

IRA Financial Trust vows to use the proceeds from the lawsuit to reimburse IRA Financial customers impacted by hack, the news release stated.

The lawsuit alleges that Gemini did not have proper safeguards in place to protect the crypto assets of customers and claims that the exchange acted too slowly to prevent more money from being stolen after IRA notified Gemini.

When reached for comment, a Gemini spokesperson told Fox News Digital that "IRA Financial was hacked and is trying to deflect blame on Gemini by filing this lawsuit."

"This is not a Gemini issue and no Gemini systems were compromised," the spokesperson continued. "While we regret that some of their customers had this experience, this incident starts and stops with IRA Financial."

Pierce stressed on Thursday that there have "clearly" been "calls for increased regulation" and recent events have only further highlighted the need for "sensible regulation."

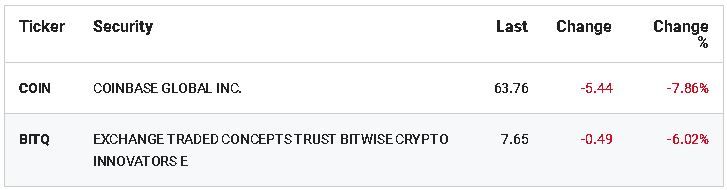

Along with the stock market, bitcoin has experienced a lot of volatility in recent weeks.

As of Thursday morning, the bitcoin was trading around the $30,000 level, down from its all-time high of over $68,000 reached in November 2021.

The crypto is down more than 34% year-to-date.

Bitcoin and other cryptocurrencies have had some rough weeks in anticipation of and following the half-point interest rate hike by the Federal Reserve.

It was the second of several anticipated increases this year as the central bank seeks to combat soaring inflation, which is at a high not seen in four decades.

The expectation now is that the Fed will take aggressive action to try and curb inflation, which has reduced investor appetite to hold assets perceived as higher risk.

Adding to more fears of volatility in the crypto market was the decoupling of the TerraUSD, a stablecoin whose value was tied to $1 last month. The world’s largest stablecoin by market cap, tether, also briefly edged down from its $1 peg.

Stablecoins are digital currencies with values that are pegged to traditional assets, like the dollar, another currency or gold. Its correspondence with the dollar is what, in theory, makes it stable. However, volatility in the crypto market challenged that presumption.

Pierce argued that "the implosion" of the stablecoins has "definitely" made regulation "a hot topic of discussion" and noted that he was happy to learn of "sensible regulation being proposed by people that have invested the time to know what they’re talking about."

Pierce was referencing the Responsible Financial Innovation Act, bipartisan legislation with the goal of creating a regulatory framework for digital assets that encourages financial innovation as well as consumer protections.

U.S. Sens. Kirsten Gillibrand, D-N.Y., and Cynthia Lummis, R- Wyo., introduced the legislation on Tuesday.

Pierce said he is "really happy to see the bill being proposed on a nonpartisan basis."

He pointed to a few "big things" in the bill, including "regulatory clarity in terms of what regulatory body should be overseeing this."

Pierce noted that several agencies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), said regulation was "their domain."

"The reality is that cryptocurrency is built upon a database architecture called blockchain and you can build anything with the database," he said.

"But the idea of the CFTC being the regulatory body would be my pick if I had to choose one versus the confusion of everyone trying to say that this is their domain, making it difficult for investors, difficult for developers to operate with all that regulatory uncertainty."