Berkshire Hathaway details selling frenzy in filing

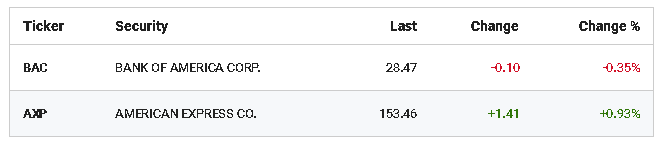

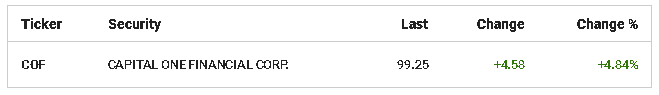

Warren Buffett’s Berkshire Hathaway purchased 9.9 million shares of Capital One Financial Corp. and dropped its stakes in the Bank of New York Mellon and U.S. Bancorp, according to a regulatory filing.

The Capital One stake would be worth $954 million, based on the closing price on March 31.

Berkshire also disclosed a $41.3 million stake in Diageo Plc, the maker of alcoholic beverages including Johnnie Walker and Guinness, in Monday's filing.

Meanwhile, Buffett's company was a net seller of stocks in the quarter, buying $2.87 billion and selling $13.28 billion as it devoted resources elsewhere, including $8.2 billion to boost its stake in truck stop operator Pilot Travel Centers to 80% from 38.6%.

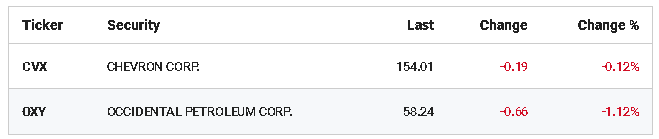

According to the filing, nearly half of Berkshire’s stock sales were in Chevron Corp and Occidental Petroleum, although Buffett maintains a 23.7% stake in Chevron.

Chevron Corp's refinery is shown in Richmond, California August 7, 2012.

Chevron Corp's refinery is shown in Richmond, California August 7, 2012.

Despite the quarter’s high volume of stock sales, Berkshire still invested in several financial services companies including Bank of America and American Express, where Berkshire's respective $29.5 billion and $25 billion stakes make them its largest stock holdings other than a $151 billion stake in Apple.