Shadow hangs over Wall St after troubled IPO but bonds still attract investment

Three years of efforts by two U.S. presidents to crack down on Chinese access to the world's largest capital market are getting a hand from unexpected quarters: Beijing.

Warnings from the top echelons of China's government of tighter oversight of data security and overseas listings, along with slowing growth amid increased regulation, have dramatically raised the stakes for mainland companies with shares traded in the U.S. -- sparking a sharp investor sell-off and threatening forthcoming offerings.

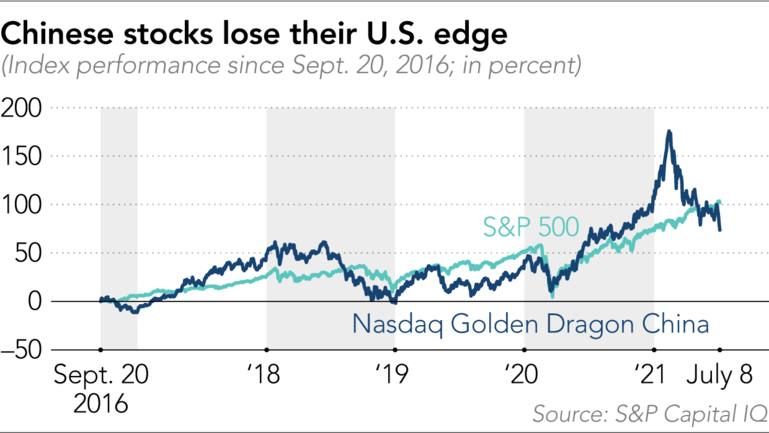

U.S.-listed Chinese stocks, as measured by the Nasdaq Golden Dragon China Index, are trading at their biggest discount to general U.S. stocks since at least September 2016 -- exceeding levels seen even at the heights of trade war under former President Donald Trump.

The index, which tracks 98 Chinese companies listed in the U.S., has fallen 10.5% since Jul. 2, when the Cyberspace Administration of China admonished Didi Global for breaching national security with its data management. That came just two days after shares in Didi, the biggest Chinese ride-hailing company, started trading in New York following a $4.4 billion IPO.

The spread between the two benchmarks has also surged at the fastest pace in at least five years -- indicating how quickly sentiment has changed and how markets have been taken aback.

Beijing has so far been hazy on some of the details of its clampdown but on Saturday it said companies holding data on more than 1 million users must now apply for cybersecurity approval when seeking overseas listings -- a move that would encompass nearly all offshore IPO aspirants.

Analysts detect a motivation to reduce exposure to the U.S. and its regulators in a bid to safeguard data and curb the reliance of mainland corporates on the world's largest capital market for funding. As of May 5 there were 248 Chinese companies listed on U.S. exchanges, with a total market capitalization of $2.1 trillion, according to the U.S.-China Economic and Security Review Commission.

"China has long desired self-sufficiency in a host of industries and it would be reasonable to think capital markets is part of the process," said market analyst Fraser Howie, co-author of the book "Red Capitalism: The Fragile Financial Foundation of China's Extraordinary Rise".

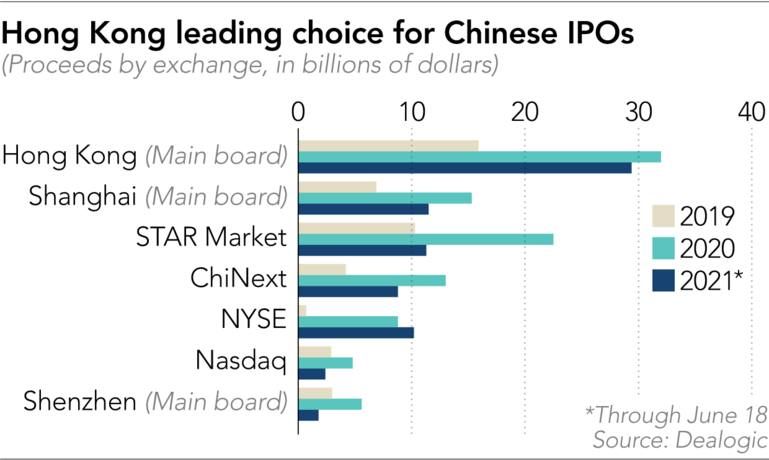

"China will prefer companies to list onshore or at least in Hong Kong as they'd want to be the regulator of their own companies. As for already listed companies, the growth story is behind them and investors are rerating the stocks already."

Some of the financial consequences of Beijing's curbs on its own "big tech" sector -- which first ratcheted up in November when China regulators forced financial services provider Ant Group to suspend what was shaping up to be the world's largest initial public offering -- have been dramatic.

Jack Ma-founded Alibaba Group Holding, which owns a third of Ant, has lost $300 billion, or a third of its market value since then. Other major Chinese companies Tencent Holdings and online retailer JD.com have ceded a combined $310 billion since their stock peaked in February.

And Didi has crashed in market value by $11 billion from a closing high on July 1 after the cyberspace regulator's broadside.

The focus is also on which companies may now rethink a U.S. listing. On Thursday, Chinese medical data group LinkDoc Technology called off its U.S. IPO at the last minute, two people familiar with the transaction said. It had been set to raise up to $210 million.

The trade war that then-U.S. President Trump unleashed in 2018 forced China to unveil a path to self sufficiency in key industries including technology and semiconductors last year. Towards the end of his tenure, Trump announced investment bans on a string of Chinese companies and endorsed rules to delist mainland companies.

Under a law passed last year, Chinese companies risk being kicked off American exchanges by 2023 if U.S. regulators are not permitted to review their audit records. Beijing forbids such reviews on national security grounds.

Current U.S. President Joe Biden has largely maintained pressure on Beijing. Last month, refining action started under Trump, he signed an executive order prohibiting U.S. residents and entities from investment in 59 Chinese companies, alleging ties to the Chinese military. And Chinese telecom companies including China Mobile have been delisted from American exchanges.

On Friday, the U.S. added 23 Chinese enterprises to its economic blacklist. Of these, 14 were included for alleged involvement in human rights abuses in the Xinjiang region, five for their ties to China’s military, and the rest for transacting with companies that had already been sanctioned.

Now, it seems that the monthslong Chinese regulatory crackdown is also having a chilling effect.

"The regulatory strong hand has deterred investors from investing in Chinese stocks," said Jack Siu, chief investment officer for Greater China at Credit Suisse. "A major topic of discussion among the investor community is when the regulatory pressures will ease. The earliest is likely to be the last quarter, but it could extend to the first half of 2022. It is not going away soon."

Over 30 companies are being investigated by various regulatory agencies and last week China's State Administration of Market Regulation announced 22 antimonopoly fines of 500,000 yuan ($77,000) each for completing acquisitions without regulatory approval.

If China does want to put more pressure on U.S.-bound companies, one way to do so would be to address what is known as "variable interest entities" -- the opaque corporate structures that have been the main vehicle for Chinese listings overseas.

Using VIEs, Chinese companies incorporated and licensed onshore can transfer profits to an offshore vehicle with shares owned by foreign investors. This has enabled Chinese technology companies to work around controls on foreign ownership.

Curbing the use of VIEs could kill off IPOs in the U.S., where mainland companies have attracted high valuations.

The barrage of regulation has also eroded the growth outlook for mainland technology companies, making them less alluring for investors. For instance, after its IPO was suspended Ant was forced to become a financial holding company, making it subject to capital requirements similar to those for banks. This and other requirements have slashed its profit outlook and its valuation.

"The technology sector becomes a bit less [about] growth and a bit more [about] value with earning growth slowdown looming," said Frank Benzimra, head of Asia equity strategy at Societe Generale. "Some value opportunities will emerge only when the market gets indications that the regulatory overhaul has been implemented. But investors need to bear in mind [that] a major objective set in the 14th five-year plan in March is reaching technology independence, which means big tech firms have a big role to play."

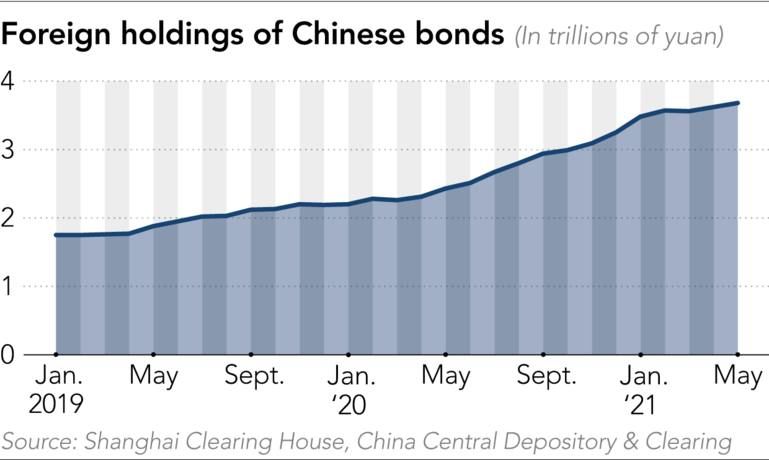

Global investors are still backing Chinese bonds and companies in the fields of renewable energy and electric vehicles that promote sustainability. So far this year, inflows into China bonds have amounted to $83 billion. Foreign ownership of the nation's bonds grew to a record 3.68 trillion yuan in May, according to regulatory data.

Investors have also bought a net $27 billion of Chinese equities via a scheme that links the Hong Kong, Shanghai and Shenzhen exchanges, Hong Kong stock exchange data show.

That means true decoupling is a long way off, according to analysts including Benzimra and Tianlei Huang, research fellow at Peterson Institute for International Economics

"It is hard to imagine that the tightening of rules on overseas listing will lead to any significant drop of U.S. holdings of Chinese securities," Huang said. "Even if obtaining a U.S. listing gets significantly more difficult for Chinese companies because of the clampdown, listing in Hong Kong or Shanghai is still a viable option and U.S. investors will still have access to those mainland companies in the two exchanges."